Jewelry Maintains Investment Allure

(Rapaport Tradewire) Capgemini and RBC Wealth Management released its annual World Wealth Report for the year 2013 and found that the world’s high-net-worth-individuals (HNWIs), or those with $1 million or more in investable assets reached a new high of 12 million in 2012. HNWIs benefited from strong stock market returns and they expressed a high degree of confidence in being able to generate new forms of wealth this year and in the future.

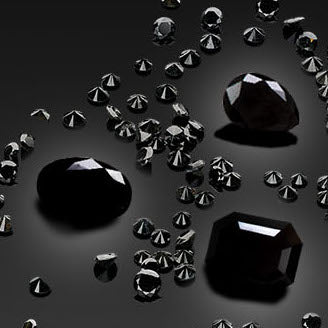

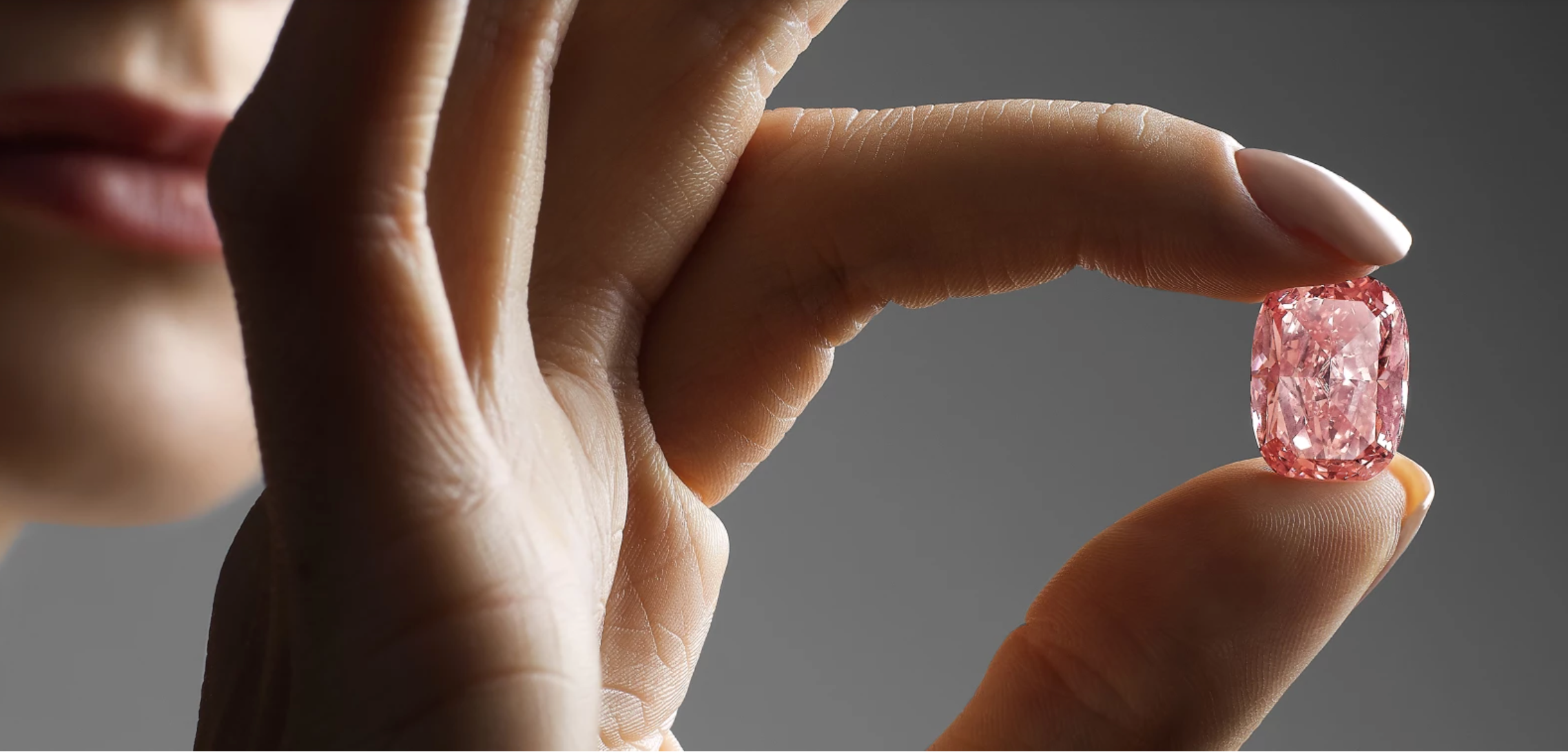

Already for the first quarter of 2013, jewelry, gems and watches remained the HNWIs' most preferred ''investment of passion'' for a second year, representing 31.6 percent of allocated funds. According to the report, collectibles, such as coins, wine and antiques, accounted for 24.4 percent of investment, while luxury automobiles, boats and jets accounted for 19 percent of allocated passion investments. HNWIs reserved 16.9 percent of allocated passion funds for artwork and 8 percent for sports-related investments.

The report concluded that art remains one of the most dynamic passion markets, especially in the emerging economies and is increasingly becoming a meaningful element of HNWI portfolios.