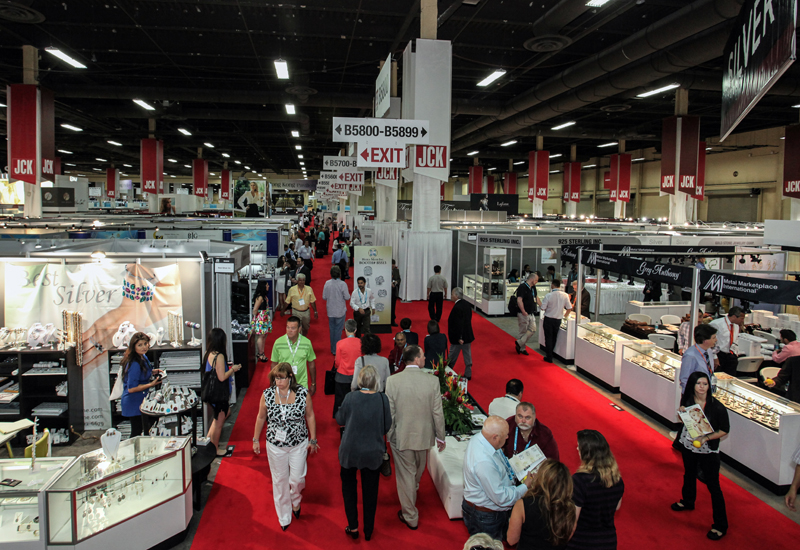

Subdued JCK Vegas Show Meets Expectations

Jun 3, 2014 5:26 AM By Avi Krawitz

RAPAPORT... The JCK Las Vegas show closed on Monday with diamond suppliers satisfied with the level of sales even though trading activity was slower than previous years. Exhibitors noted that buyers bought goods to fill orders but they avoided larger scale purchases to fill inventory. Similarly, inter-dealer trading was stable but slightly subdued.

“Demand is consistent and we’re selling the commercial price-point products in the U.S.,” said Dotan Meirov, the chief operating officer at MID House of Diamonds, a polished diamond distributor. “The market is stable and so are prices.”

Most exhibitors who spoke with Rapaport News noted that visitor traffic was down from last year with some suggesting that fewer middle-market independent retailers were in attendance. In addition, they reported that there were fewer buyers from the Far East than was the case in 2013.

Prakash Narola, the owner of Diamonds on Fire, explained that it’s becoming more difficult for smaller businesses across the pipeline to survive as the bigger groups are consolidating and squeezing out the smaller companies. Dealers noted that most of the large U.S. retail jewelers were at the show meeting their suppliers.

A New York polished dealer who requested anonymity suggested that in contrast to the Far East, the U.S. does not have many buyers who are looking to build inventory. “You have a few big players that have programs but the rest are stores that are looking to fill orders and are not buying for stock at the moment,” he said. “The middle market has a limited amount of money to spend and was not in Vegas in big numbers.”

David Grunberger, the president of Grunberger Diamonds, a manufacturer of small ideal-make diamonds in hearts and arrows, observed that buyers were more focused this year and came with the intent to build relationships and move their businesses forward. Others agreed and stressed the strong networking opportunities provided by the show.

Still, Nader Malakan, of Malakan, a jewelry manufacturer and supplier to small independent retail jewelers, reported that the market is good for commercial-quality diamonds in clarities of VS and lower.

He noted that sentiment about the economy has slowly improved in the past two or three years. Similarly, Isaac Berman of Berman Diamonds, an Israel-based polished supplier, observed that the general feeling is that the economy is improving and that people are buying luxury products again.

As a result, most were satisfied that the positive momentum from the beginning of the year was maintained at the show and expect the market to remain stable in the second half of the year. “May was strong for us and the show was a good way to end the month,” said Zachery Ruttenberg, a sales manager at Emby International. “We can now renew our strategies as we head into the summer and fall months.”

The following trends were observed by diamond suppliers that spoke with Rapaport News:

• There was good demand for 0.30-carat to 0.70-carat, G-J, VS-SI goods.

• There was strong demand for non-certified pointer sizes in parcels.

• Demand for certified 1-carat to 2.99-carat diamonds was on the weak side.

• There were a lot of inquiries for 3-carat and larger sizes.

• There were shortages of good-quality fine-cut diamonds.

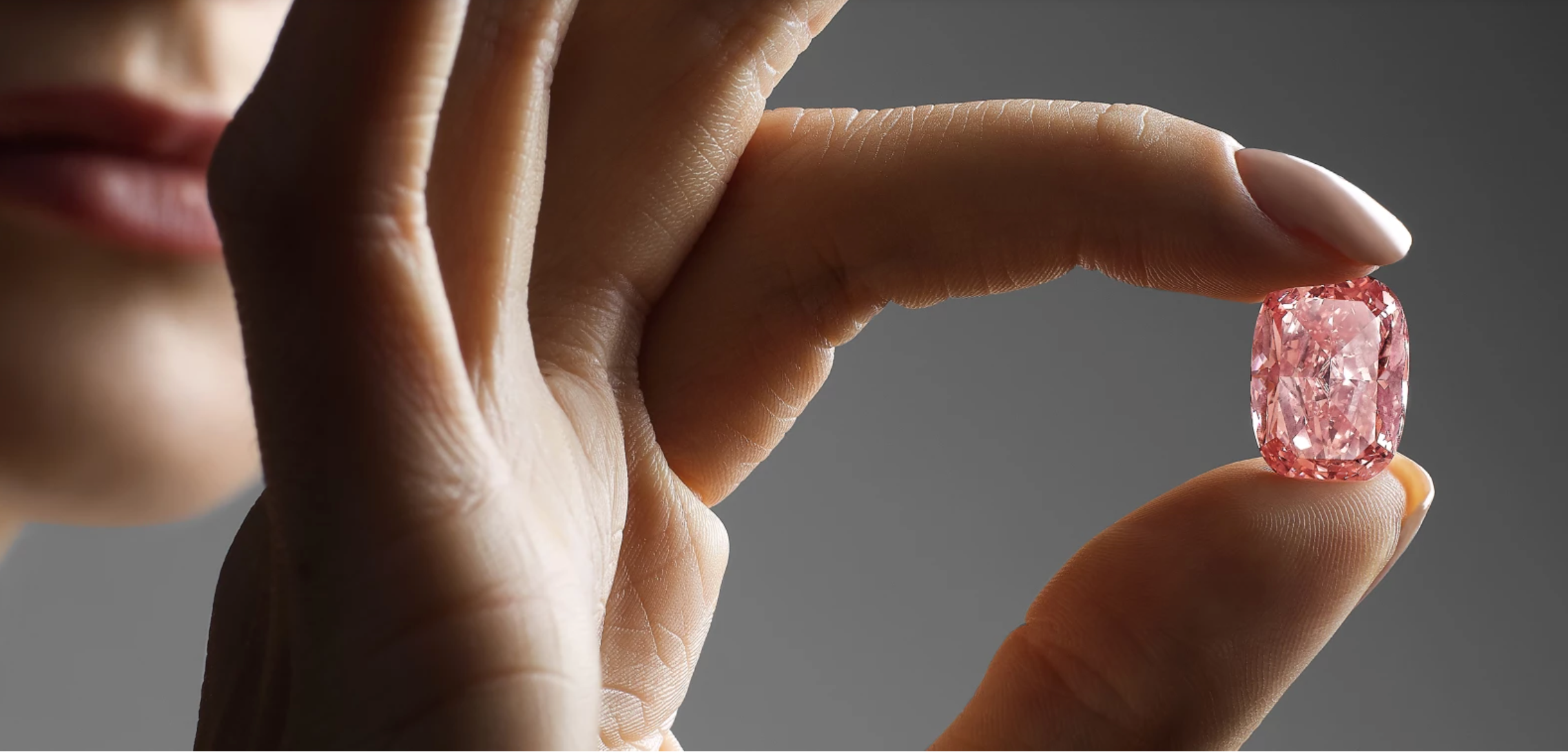

• The market for large, special stones has slowed slightly in recent weeks following disappointing prices at the Geneva auctions.

• Commercial-quality, fancy color diamonds remain strong.

• There was steady demand for fancy shapes with pears and ovals being the most popular items and improving demand for princess cuts below 1-carat. Baguettes are moving but are difficult to find.