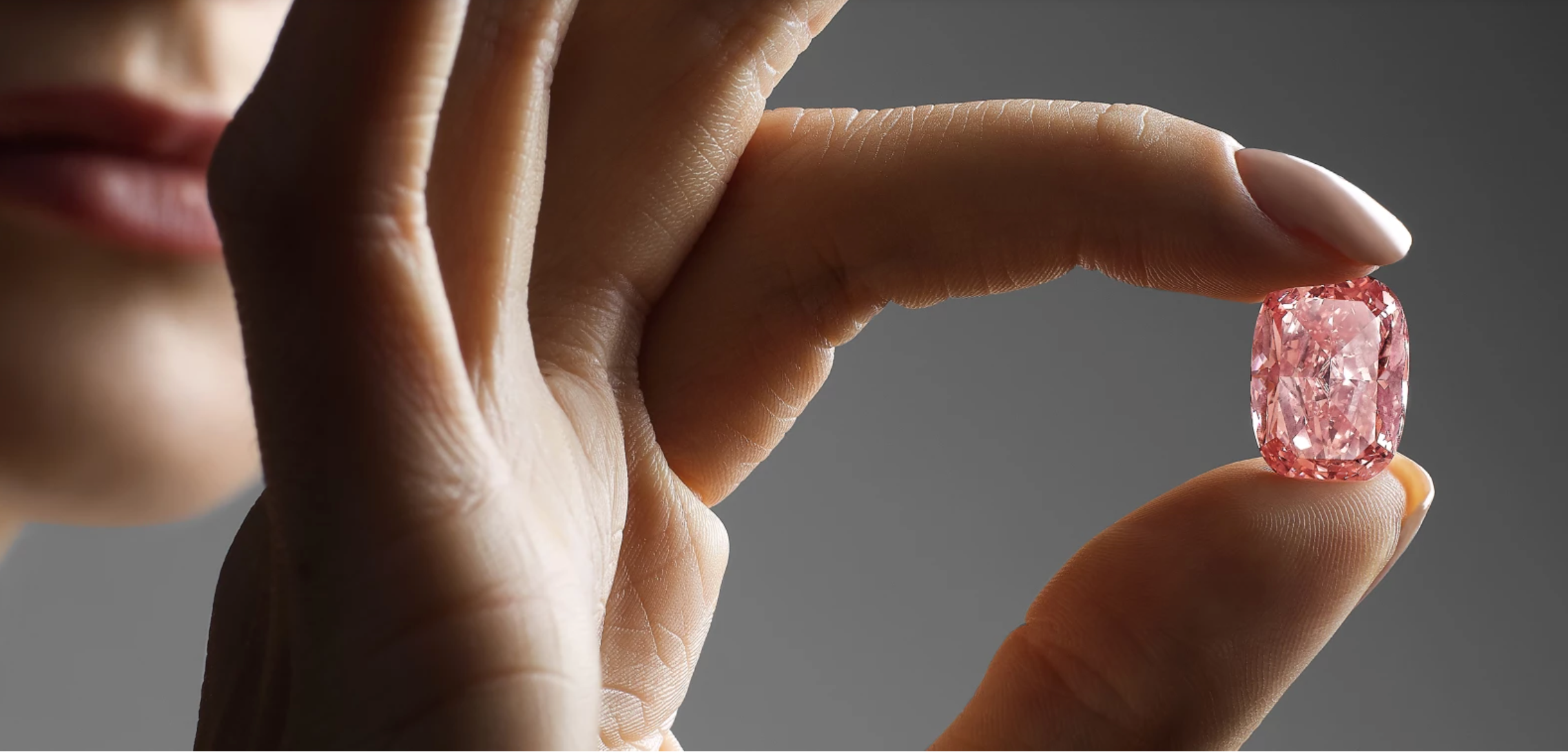

Diamonds May be the Next Big Thing in the Futures Market

[Marketwatch] Move over gold bugs! Futures traders in precious assets may have a new best friend: diamonds.

That’s if Martin Rapaport has his way. The chairman of the Rapaport Group, a source of pricing and other market information in the diamond world, first wrote a diamond-derivatives proposal for the New York Commodities Exchange back in 1982. It was rejected.

But Rapaport has been working on it ever since—and believes that creating a futures market for diamonds is well within reach. In fact, he’s aiming for a late 2016 to early 2017 launch.

Rapaport isn’t the only business mind to try to establish a diamond-backed futures market, efforts have been made to establish one in fits and starts over more than 30 years.

But Rapaport said it can only become a reality with a spot-cash market. “You can’t have a derivatives market without a legitimate, transparent, competitive and efficient spot-cash market,” he said.