Dazzling Returns

The Wall Street Journal | Life & Culture | By Farha Sait

Jewelry is the most portable of investments, and we look at some spectacular colored gems that have come to market recently.

DOWNTOWN GENEVA GLITTERED this month as the world’s wealthiest descended on Christie’s and Sotheby’s twice-yearly haute joaillerie auctions, in search of colored diamonds, jewelry with provenance, and signed pieces.

Key lots in this month’s auctions included pieces from the covetable collection of Dimitri Mavrommatis such as the Graff Ruby (an 8.62-carat Burmese stone) and a Kashmir sapphire and diamond ring weighing 27.54 carats and carrying an estimate of between $3 million and $6 million—at Sotheby’s. And at Christie’s, the Empress Eugenie Feuilles de Groseillier 19th-century brooch, which last saw an auction room in 1887, and appeared in Geneva with an estimate between $2 million and $3 million. The Blue Belle of Asia, also at Christie’s, is a 392.52-carat Ceylon sapphire at the center of a diamond necklace. Its estimate was $7-$10 million.

Trade insiders say clients are increasingly buying diamonds as investment, to hold for a few years and then resell. The 2012 Barclays Wealth Insight survey of 2,000 high-net-worth individuals revealed 70% of the respondents owning precious jewelry as part of their investments, as compared with 57% five years previously.

‘People who had the money before but did not consider diamonds are coming into the picture’

—Eric Valdieu, Valdieu Fine Arts

“The market in [the] top bracket is tipping, with two out of three people in an auction buying for investment,” says Eric Valdieu, of Valdieu Fine Arts, and a former vice president at Christie’s, Geneva. “People who had the money before but did not consider diamonds are coming into the picture; the client base is growing and product shrinking. They only want top-quality stones and that’s why prices are soaring in this category.”

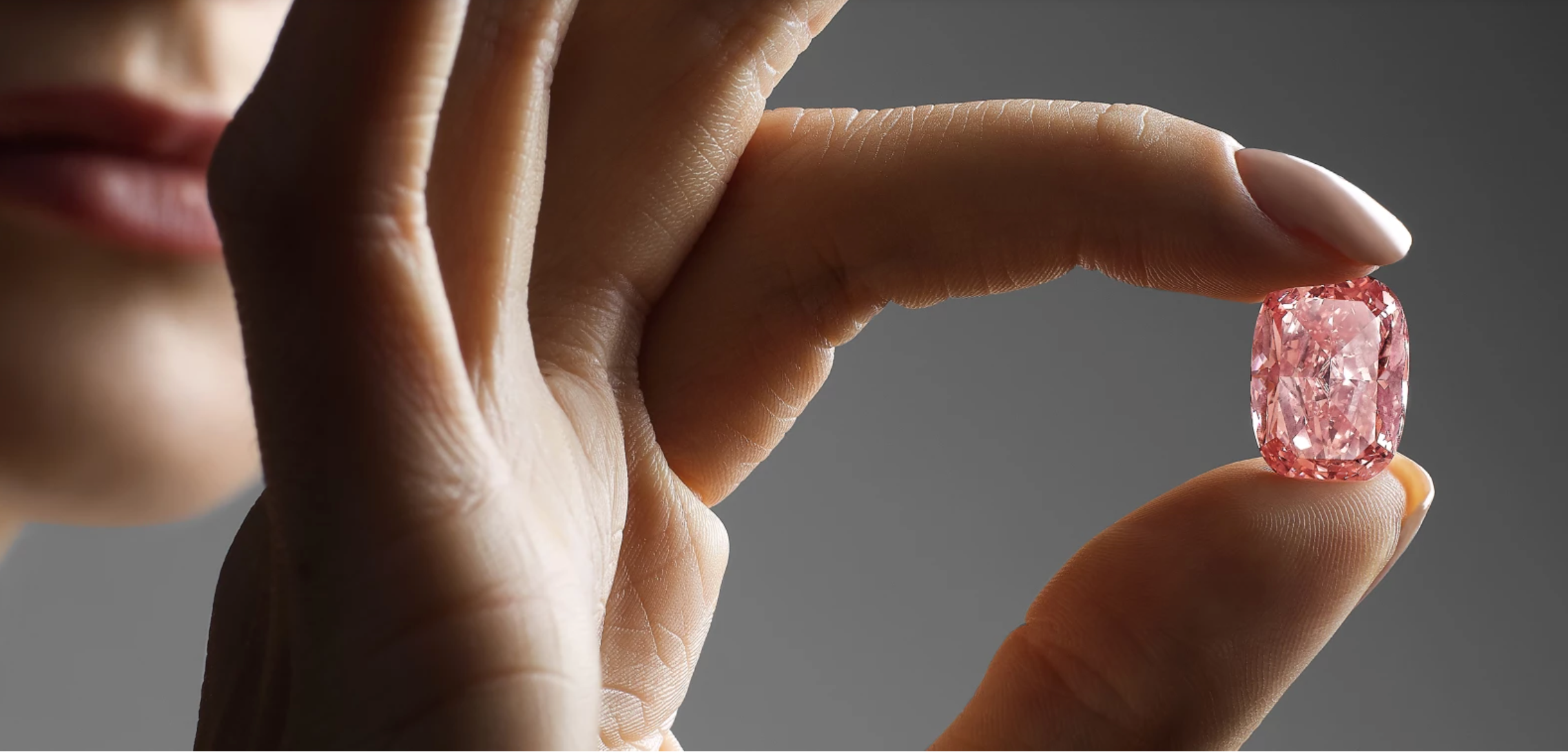

Colored diamonds are much in demand, David Bennett, chairman of Sotheby’s Jewellery Division for Europe and the Middle East, says. They are hotly contested and feisty bidders are driving the market.

Diamonds become colored from exposure to radiation or due to internal inclusions. The intensity of the color is what makes them desirable. Unlike gold, there is no price index for colored diamonds. The widely accepted Rapaport list gives prices per carat for white diamonds, but colored ones are so rare, says Mr. Bennett, that you cannot fix an index. This doesn’t deter buyers, though, he says, adding that, right now, yellow stones are most coveted.

In another part of town, Christie’s is also witnessing increased demand. “Seeing the prices these items are commanding, we have collectors coming to us with rare pieces to sell,” says its specialist Daniel Struyf. Last November, the Orange—the world’s largest vivid orange diamond—fetched $35.5 million, a world-record price per carat for a colored diamond. And in May, the Blue, a flawless, vivid blue, 13.22-carat stone, fetched $23.7 million.

Colored diamonds make up a tiny percentage of world diamond production, according to the Gemological Institute of America (GIA), which certifies every stone to come to auction. It lists Australia’s Argyle mine as the major source of pink and red diamonds, while South Africa’s Cullinan mine yields most of the exotic blues.

“But there’s more than just rarity,” says Mr. Struyf: “Cut, carat, provenance and signature all dictate prices. Take the Rajah, the white Golconda diamond, which came with a staggering provenance, circa 1885, royalty, and from a mine that doesn’t produce any more.” Auctioned by Christie’s in 1997 it went for $2.8 million; in May, it fetched $4.35 million.

Emerging markets are also pushing prices, veteran diamond dealer Serge Fradkoff says by phone from his home in France. “Earlier, main markets were [the] U.S. and Europe. In the last decade, Russian, Indian and Middle Eastern players aiming for top lots [have been] stoking [the] market to current highs. China’s superrich want the best—even a GIA-certified 99% quality isn’t good enough for them.”

His own treasure includes a necklace of table-cut diamonds dating from the 17th-century Mughal dynasty, which is currently displayed at the Moscow Kremlin Museum. The prices of Kashmir sapphires and Burmese rubies have shot up even higher than diamonds, as the mines in these regions have stopped producing. What’s on the market today dates from about 100 years ago. The finest sapphire today would be worth one and half times the price of the finest diamond, says Mr. Fradkoff. However, “it will not appreciate that much more, as prices have already hit the ceiling.” For investment, he says, “I would stick to diamonds: 5- to 10-carat of top quality for medium- to long-term.”

Not everyone is so sure of diamonds as investments, however. According to Greg Davies, head of behavioral finance at Barclays, the treasure trend kicked off with the 2008 financial crisis. “People became fearful of anything abstract like stocks and shares; they swung instead into tangible investments like classic cars, fine arts and jewelry, often for emotional reasons, convincing themselves it’s sound,” he says. “There is very little fundamental basis why the prices of diamonds are going up so rapidly, except that lots of people are buying them.”

Jeweler Pascal Mouawad has no such doubts. His family owns one of the finest collections of diamonds in private hands, including a 69.42-carat diamond given to Elizabeth Taylor by Richard Burton. “We have a passion for rare diamonds,” Mr. Mouawad said by email from New York, “and they are an ideal investment vehicle, easy to move around and sell globally.”

For buyers who share that passion, auction houses—despite a 25% premium on the price—remain a sound place to source rare pieces. And, as Mr. Mouawad said: “It is thrilling to bid and win at an auction.”

Whether diamonds, or colored diamonds, are forever, only time will tell, but they are certainly of the moment.